Compound is a platform for lending and borrowing ethereum assets like ether, Dai and USD Coin. It’s implemented as a set of smart contracts that control the interest rates and the liquidity pool (which is the amount of assets available to be withdrawn at any time) without human interaction!

Why would you want to lend or borrow ethereum assets though?

Borrowing

If you want to bet on the value of an asset going up then all you have to do is buy some, wait and then sell it. But if you want to bet on the value of an asset going down then you need to short it, which is where you:

- Borrow some

- Sell it

- Wait for the value to go down

- Buy some (for less than you sold it for)

- Repay your loan

- Profit

Loaning

All those people looking to short assets need to borrow them from somewhere, and they’re willing to pay interest on their loans. That means people who loan out the assets can make money too.

How to loan it

Before I get into this I need to say there are any number of things that could go wrong when loaning ethereum assets. Don’t spend any money you don’t mind never seeing again.

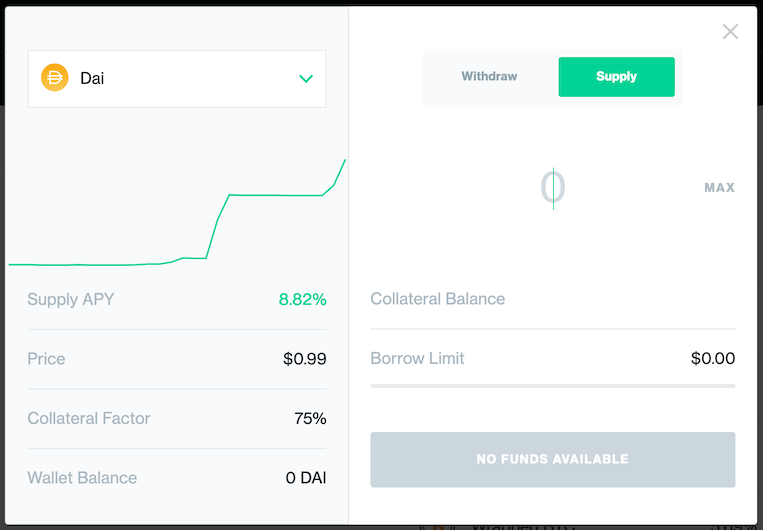

If you’ve got MetaMask installed and a loanable asset (like Dai) in your wallet, then loaning it out is as easy as visiting the Compound web interface and hitting the Supply button.

If you need to get a loanable asset then have a look at the Getting Some post for how to get some eth and the MetaMask post for how to swap it for Dai.

So far I’ve only supplied Dai, because it’s pegged to the value of the US dollar. I hope that means its value will stay stable.

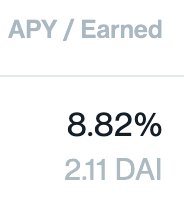

Once you’ve supplied some assets you can sit back and watch your interest accumulate.

At the time of writing the supply interest rate is 8.82%. An average savings account here in the UK offers 1.2%, so supplying Dai is an attractive option. Especially as (in theory) you can withdraw it at any time.

In the next post we’ll talk about an application built on top of Compound: Pool Together.